The Power of Good Corporate Governance

Good governance is essential when it comes to building confidence from investors and harnessing shareholder value.

What is corporate governance?

Corporate governance pertains to the way in which companies are controlled and directed. If a company has good corporate governance, that means it is being managed in an effective way. This includes the way in which relationships between management, Boards and shareholders- or stakeholders are navigated within the business.

While the focus on good corporate governance can fall on publicly listed companies’ shoulders, practising good governance is key for non-listed companies, too. Both types of organisations will reap the benefits of good governance. However, the national codes set out in many countries as a framework of corporate governance practices ideal for guiding listed companies, whilst desirable, may not be mandatory for non-listed companies in the same way that they are for their listed counterparts.

Non-listed companies are major contributors to their nations’ economies, and the rewards of good governance, particularly its ability to heighten shareholder and investor participation, are important to recognise.

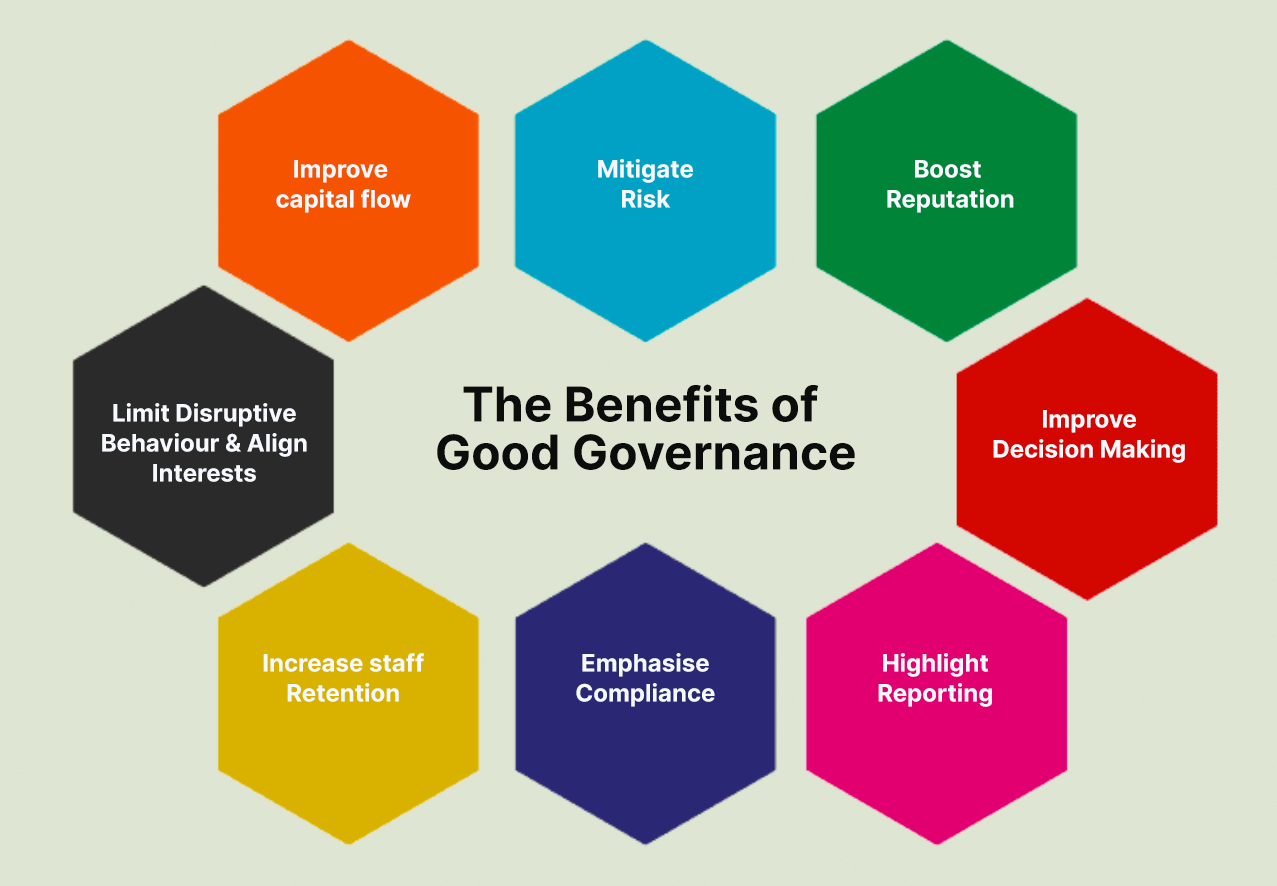

What are the benefits of good corporate governance?

Good governance is the foundational building block to generate trust from investors in the organisation, demonstrating reliability and honesty in business practices. Additionally, good governance can:

Improve capital flow: Good governance is an easy way to gain the confidence of your investors and banks, as they feel they can rely on companies with robust financial management reporting. This can help you access capital, minimise costs of capital and equity and streamline capital flow. The right type of capital structure for your business is a key part of good governance, as is transparency in all of your practices – and in particular, where investors are concerned. If you can lower your risk premium as an organisation, you will lower the cost of capital and equity, benefiting everyone involved.

Mitigate risk: A strong governance framework provides a roadmap for navigating risk and reassures shareholders – especially in non-listed companies – that even if exists are difficult, their interests will be safeguarded by the Board and management. This framework should also cover exit strategies, establishing norms and procedures to guide prospective shareholders and help assure them of the rightness of their decision to invest in the company.

Boost reputation: Transparency in business practices at all levels is more important than ever from a consumer point of view. This includes being open about internal company policies, control mechanisms, supply chain practices, vendors, media, staff and government body liaisons. If your company is known for being honest in its practices, then your reputation will grow, and your brand value will follow suit.

Improve decision-making: Good governance can also help to establish a clear method of decision-making so that when it comes time to make a tough call, those in charge can follow precedents. It can further help clarify roles between leaders and management and increase the speed of decision-making overall.

Highlight reporting: An increased awareness of performance reporting is par for the course when it comes to good corporate governance practices. This helps managers and owners make more informed, fact-based decisions, improving sales margins and mitigating costs for the company.

Emphasise compliance: A requirement of good governance is compliance with local laws and regulations of the field. A company practising good corporate governance will have established policies regarding their compliance. They should strive to sync risk management and compliance awareness to bolster company control mechanisms, helping it reach its objectives and operate efficiently on all levels of the organisation.

Increase staff retention: Having a clearly defined and attainable goal for the company in line with good corporate governance initiatives will motivate staff and encourage them to invest in the vision with their professional time and effort. Clear communication regarding the direction of the organisation will help them feel integrated into the business and encourage them to stay on. Shareholders will also be attracted by clear, succinct definitions of the company’s core and long-term goals, and establishing these will help you enter the market of your field. Moreover, the younger generations entering the workforce now are highly committed to transparent and sustainable business practices, and having a demonstrable commitment to ethics throughout the organisation will help make you their preferred employer.

Limit disruptive behaviour and align interests: Being able to cite established rules and regulations for your company in line with good governance principles can help reduce rates of fraud and malpractice amongst your staff. It can also help steer you clear of conflicts of interest, as shareholders feel they are given equal opportunities to voice their opinions through representation by independent directors.

There is a demonstrable correlation between good corporate governance and the successful market performance of listed companies. When it comes to non-listed companies, private equity investors are generally more willing to trust and share their investments with companies that have a track record of reliability, as demonstrated by their commitment to good corporate governance standards and practices.

In our modern era, employing good governance in your organisation should be second nature and is a requirement for all companies looking to glean shareholder confidence and unleash that value in their business practices. Investors often look to the governance capital of target companies as evidence for whether they should collaborate or not, just as they consider technological and human capital prior to investment. Good governance is also important in times of economic instability, as best practices can help companies weather the economic storm.

What does good governance look like in practice?

It is usually pretty clear when a company is operating under principles of good corporate governance – and even more so when they are not! Signs that an organisation is exercising good governance include:

- The Board represents a variety of opinions and backgrounds equally

- An organised, centralised system of Board management that enables collaboration

- Strong ethics and legislative compliance

- Cutting-edge ESG practices and a commitment towards sustainability

- Effective internal and external communication (including with share- and stakeholders)

- An established method of self-evaluation and clear goals in these areas

How can technology support good corporate governance?

If good corporate governance is not your company’s present, then it should be its future. It is far more achievable and beneficial than you may realise. Whilst ideal governance practices may seem lofty and out of reach, taking tangible steps in their direction will make huge differences in the capacity and integrity of your company. Technology can help support you in this transition by automating aspects of governance for you and your team. Many services now exist to help increase accessibility and efficiency for all business professionals in your organisation whilst giving you back your time so that you can focus on the true goals of your business. This support can help you make good corporate governance a top priority, as it should be.

Check out our Board portal buyers guide on the right to learn more about how technology can help you achieve your governance goals.

If you're looking for a tool to streamline your Board processes, check out BoardPro - an all-in-one software solution designed specifically for Boards and busy CEOs!

Schedule a demo with our team today and begin to experience a whole new way of meeting.

Share this

You May Also Like

These Related Stories

Tips for developing a governance handbook

The seven benefits of good governance